- Simply click to express on LinkedIn (Reveals in the screen)

- Simply click so you’re able to email address a relationship to a pal (Reveals within the this new windows)

- Mouse click to share with you to the Texting (Opens in the fresh screen)

- Click to reproduce link (Reveals inside new windows)

The firm are rebranding Lenders away from The united states to create the newest Zillow term, and certainly will utilize the bank to invest in home buying and attempting to sell through its Zillow Has the benefit of platform

Consistently, potential homeowners could check for home financing because of Zillow’s web site, since the lenders reduced to possess their attention cost and you can conditions listed for the Zillow’s financial areas. Now, they are going to provides another rival: Zillow itself.

The firm was rebranding Mortgage lenders regarding The united states to take the fresh new Zillow label, and can make use of the bank to finance home buying and you can attempting to sell with the Zillow Also offers system

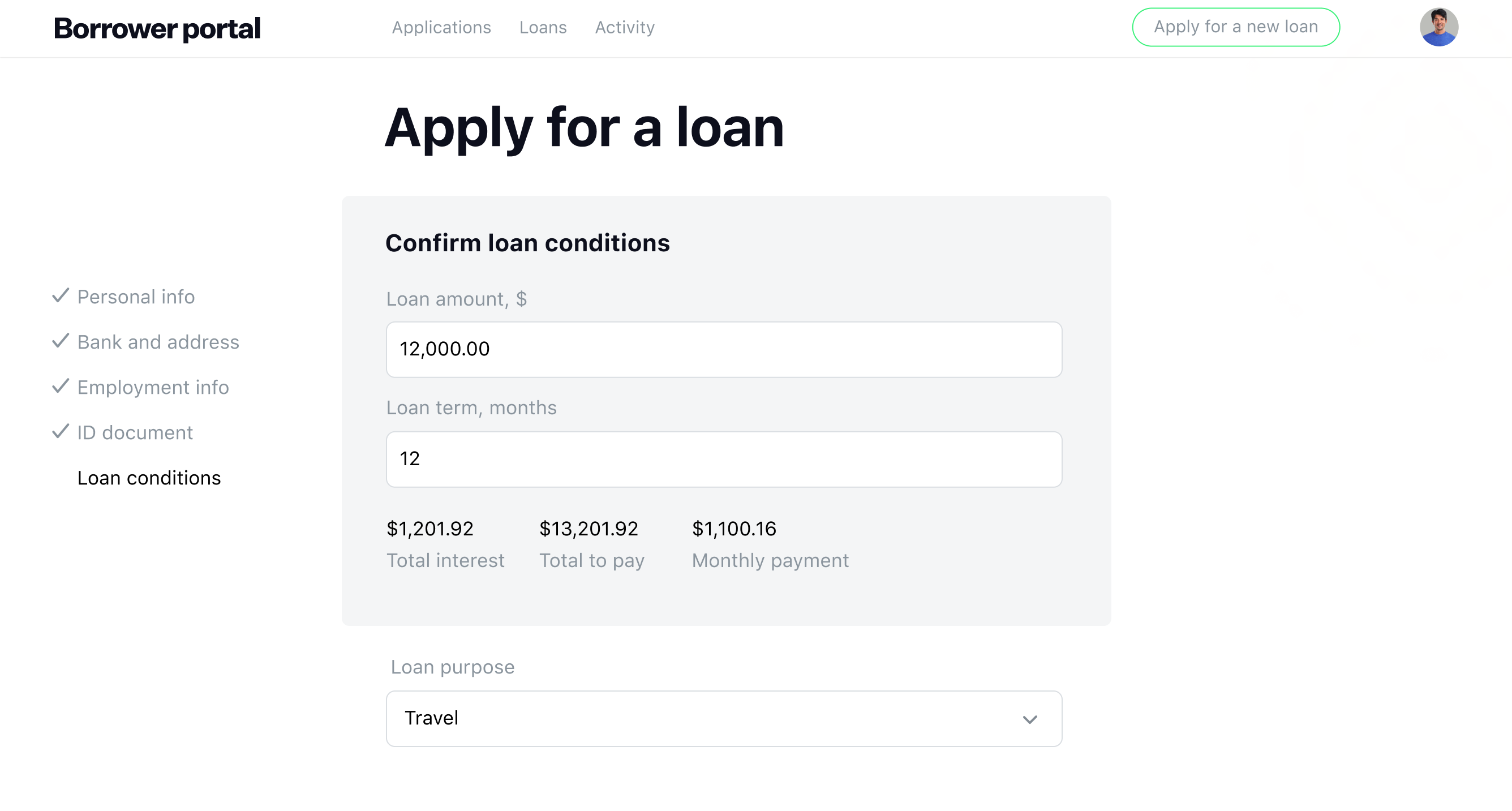

It is a very big disperse to own Zillow, and this relates to the alteration instead just: Domestic consumers exactly who go to Zillow to acquire home financing is also now get money right from Zillow Home loans.

Back in 2015, former Zillow Ceo Spencer Rascoff asserted that the business opinions itself as a media providers, not a bona fide house company.

I sell advertisements, maybe not domiciles, Rascoff said at that time. We are all on providing people with entry to suggestions right after which hooking up them with local pros. Therefore we create a fantastic job of offering those people local top-notch high-high quality lead, they will covert people contributes to during the a higher level right after which wanted far more news impressions from all of us. Very we are not in reality about deal, we have been on media organization.

Zillow keeps owned a mortgage team for about half a year, which have bought Mortgage lenders out of The usa in the , however, the net real estate icon has truly getting a lending company also

Within the 2017, Zillow shook-up the genuine property business in the event it launched that it was entering the house attempting to sell company from the unveiling Zillow Immediate Now offers.

Throughout the system, home owners trying to promote their house in some locations had the ability to find dollars also offers because of their family regarding chosen people interested when you look at the to buy they, every inside Zillow’s platform.

But that has been only the start. After, Zillow first started buying and selling property straight to and you can out of home owners, getting an iBuyer. With their Offers program, Zillow acquisitions property directly from a seller, helps to make the requisite solutions and you can status and you will listing the home as quickly as possible.

This past year, the web real estate land managed to move on drastically whenever Zillow established one it had been entering the borrowed funds company by buying Mortgage lenders out of The usa.

Considering Zillow, the acquisition off Mortgage brokers of The united states will allow the organization so you’re able to streamline and you may reduce our home-to get techniques having customers exactly who get home because of Zillow Even offers.

The organization paid off $65 mil to acquire Mortgage brokers out-of America, and you may finalized toward contract later just last year. At that time, Zillow mentioned that they wished to rebrand MLOA, that is just what it has now over, rebranding the mortgage business to take the Zillow term.

Taking a mortgage is usually the toughest, extremely challenging section of to purchase a property. Given that our very own first, Zillow has been strengthening https://paydayloancolorado.net/pine-valley/ individuals with suggestions and tips and come up with wiser a property decisions, along with enabling consumers buy a knowledgeable financial and you can financing to own their brand new house, said Erin Lantz, vice president and you will standard director from mortgages in the Zillow.

With Zillow Mortgage brokers the audience is bringing an amazing step forward to deliver a payments platform accomplish the credit for Zillow Offers that delivers a very seamless, on-request a house sense today’s users predict, Lantz added. We still render people the efficacy of substitute for shop for money privately using Zillow Home loans or courtesy our common mortgage marketplace.

According to organization, property owners using Zillow Offers to sell their house can be without difficulty safe the financing owing to Zillow Lenders, providing them with this new certainty being offer its established house and you may look for a different sort of domestic on top of that.

Likewise, homebuyers who want to buy a home that Zillow is the owner of lessly fund their home purchase, giving them a convenient way to get into their new home to their plan, which have reduced troubles and you can fret, the firm said.

But the organization extra the use of Zillow Home loans is actually not limited to help you Zillow Now offers home conversion. Centered on Zillow, borrowers might still have fun with Zillow’s mortgage opportunities to shop for a great financial and you can financing when it comes down to house pick or refinanced loan.

Zillow Also offers has become for sale in 9 markets, considering Zillow. Zillow Home loans try based from inside the Overland Park, Ohio, and it has over 300 staff.